1.1 Trends & Problems

1.1.1 Singaporean’s motivation to improve their health

A survey polled a total of 1,000 Singaporeans aged between 18 and 70 across various income groups, education levels, races and professions ( conducted by marketing communications agency Wunderman Thompson between February and March, 2021)

Singaporeans are leading healthier lives but experiencing more mental health problems: Survey

The survey found that 66 per cent of respondents are more motivated to be healthy and 72 per cent have declared their physical health “very much” a priority.

They are also:

-

Feeling physically healthier than before the pandemic (44 per cent)

-

Exercising more (50 per cent)

-

Eating healthy meals more often (46 per cent)

-

Spending more on being healthy (54 per cent)

The survey authors said increased sales seen by bicycle shops and shared-bike services in 2020 showed that Singaporeans are spending more time and money on their health.

They also noted that home gym equipment was also among the bestselling items on online shopping site Lazada Singapore during the Singles’ Day sale in November last year.

“The nature of Covid-19, where the oldest and sickest are most likely to die if infected, has been an impetus for many to focus on staying well,” said the researchers.

However, as Singaporeans attempt to get physically healthier, many have picked up or increased their unhealthy habits in the last year, which include:

-

Spending more time on screens (73 per cent)

-

Becoming more sedentary (61 per cent)

-

Eating more junk food (46 per cent)

-

Not sleeping enough (40 per cent)

-

Drinking more alcohol (17 per cent)

-

Smoking more (13 per cent)

These unhealthy behaviors differ by income levels, the survey found, with high-income individuals reporting habits such as eating sweets, drinking coffee and smoking or drinking. Meanwhile, middle-income individuals are working long hours and eating more fried or junk food, and people earning lower income are living more sedentary lives and binge eating junk food.

⇒ Insight: Singaporeans are motivated to be healthy and think physical health is very important.

1.1.2 Singaporeans willingness to pay higher for organic products

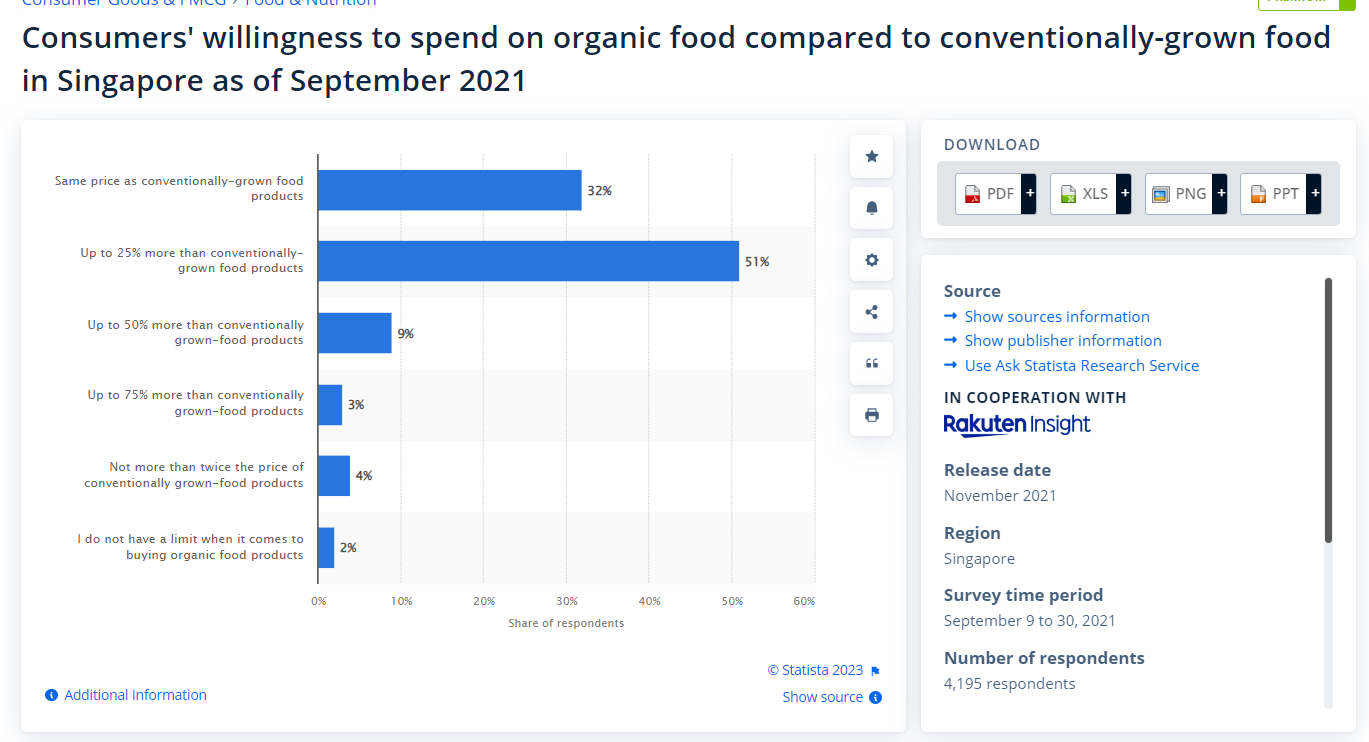

According to a survey on organic food conducted by Rakuten Insight, 51 percent of the Singaporean respondents stated that they would pay up to 25% more than conventionally-grown food products. In comparison, 32 percent of respondents in Singapore stated that they were only willing to pay the same price as conventionally-grown foods.

Consumers’ willingness to spend on organic food compared to conventionally-grown food in Singapore as of September 2021

⇒ Insights: Singaporeans are also willing to pay higher price for organic food products (Singaporean respondents stated that they would pay up to 25% more than conventionally-grown food products)

1.1.3 Rising rate of diabetes among Singaporeans

In Singapore, over 400,000 Singaporeans live with the disease. The lifetime risk of developing diabetes is one in three among Singaporeans, and the number of those with diabetes is projected to surpass one million by 2050 [1]. An estimated 430,000 (or 14% of) Singaporeans aged 18 to 19 years are also diagnosed with pre-diabetes, where their normal blood sugar levels are higher than normal but not high enough to be diagnosed as diabetes [3].

Diabetes in Singapore is on the rise, and younger Singaporeans are becoming diabetic at a younger age. Research studies conducted by the NUS Saw Swee Hock School of Public Health have found that 34% of the young adults aged 24 to 35 would be susceptible to diabetes by the age of 65.

⇒ Insight: Singaporeans in the near future will be aware of the rising danger of diabetes in their generation, therefore they will look for sugar alternative products to prevent diabetes.

1.2 Competitive analysis

|

Popular organic honey brands in Singapore

|

|

Name & Description

|

Price

|

Product Line

|

|

Y.S. Eco Bee Farms

|

Eco Bee Farms is a well-established brand that specializes in organic honey products.

They offer a range of raw, unfiltered honey sourced from various floral sources, ensuring high-quality and nutrient-rich options.

|

Raw Honey _ 623g_ ( 305.000vnd)

Organic Raw Honey_454g_13.49$ (317.000vnd)

⇒ Average price is cheaper compared to that of Karuna

|

|

|

GloryBee

|

GloryBee is a brand committed to sustainable and responsible beekeeping practices.

They offer a diverse selection of organic and fair-trade honey varieties, including raw honey, creamed honey, and regional-specific options.

|

Simply strained Pacific Northwest Blackberry organic honey

360ml _ 38$ ( 892.000vnd)

Simply strained Oregon organic honey_360ml _ 38$ ( 892.000vnd)

Raw Oregon Honey_540ml_ 55$ (1.292.00nvd)

Raw washington honey_540ml_55$

(1.292.00nvd)

⇒ Average price is higher compared to that of Karuna

|

|

|

Honey Gardens

|

Honey Gardens is known for its artisanal honey products that are produced with a focus on sustainability.

They offer raw honey, infused honey with herbs and spices, and honey-based herbal remedies.

|

Lemon & Honey Vitamin C Syrup_237ml_$23.39 (564.00vnd)

Cherry & Honey Soothing Throat Syrup_237ml_$23.39 (564.00vnd)

Ginger & Honey Digestive Syrup_237ml_$23.39 (564.00vnd)

RawHoney,Wildflower_270ml_12.99$( 305.000vnd)

RawHoney,OrangeBlossom_270ml_12.99$( 305.000vnd)

⇒ Average price is higher compared to that of Karuna

|

|

|

Really Raw Honey

|

Really Raw Honey is a popular brand that offers unprocessed, raw honey straight from the hive. Their honey is known for its distinct flavor and texture due to its minimal processing.

|

230g → 4.5tr

2kg → 5tr

0.5kg→ 4tr277

⇒ Average price is much higher compared to that of Karuna

|

|

|

Wholesome Sweeteners

|

Wholesome Sweeteners is a brand that emphasizes organic and ethically sourced ingredients.

While they offer various sweeteners, they also provide organic raw honey as a natural and healthier alternative.

|

ORGANIC FAIR TRADE RAW UNFILTERED WHITE HONEY JAR_

454g_ 12.89$( 302.00vnd)

ORGANIC FAIR TRADE HONEY _

454g_ 12.89$( 302.00vnd)

⇒ Average price is cheap compared to that of Karuna

|

|

|

Wedderspoon

|

Wedderspoon is a renowned brand known for its premium organic honey, particularly their Manuka honey. They offer a variety of Manuka honey products with different potency levels and certifications.

|

500g ⇒ 1tr

500g ⇒ 657,510 vnd

325g ⇒ 563,580 vnd

⇒ Average price is higher compared to that of Karuna

|

|

SWOT analysis

|

STRENGTHS

Local sourcing and production: One of the strengths of Karuna honey is its local sourcing and production in Vietnam. This emphasizes its connection to the region and highlights its commitment to supporting local beekeepers and sustainable practices ⇒ This can resonate with consumers looking for honey that is produced locally and supports local communities.

Potential for unique flavor profiles: Vietnam is known for its diverse flora and unique ecosystems. Karuna honey has the opportunity to offer distinct flavor profiles that reflect the floral sources found in Vietnam. This can be a strength in attracting consumers who appreciate the unique and authentic taste experience offered by honey produced in specific regions.

Organic and high-quality honey

Relatively cheap prices compared to that of other popular organic honey brands

|

WEAKNESSES

Lack of variety in the product line. Many other brands in Singapore offer honey with many different distinct flavors or infused honey with herbs and spice or herbal remedies ⇒ limit consumer choices and potentially reduce its competitiveness against brands that offer a diverse selection of honey types, flavors, and value-added products.

Limited international recognition and presence.

Lack of honey quality certifications

Food Safety System Certification 22000 (FSSC 22000): FSSC 22000 is a globally recognized food safety management system certification. It ensures that the honey production processes meet international standards for food safety, including hazard analysis, hygiene, and quality control.

Hazard Analysis and Critical Control Points (HACCP): HACCP is a systematic approach to food safety that identifies, evaluates, and controls potential hazards in food production. Implementing HACCP principles helps ensure the safety and quality of Karuna honey, which is crucial for export to Singapore.

Organic Certification: If Karuna honey is produced using organic beekeeping practices, obtaining an organic certification is important. Singapore recognizes various organic certification bodies, such as USDA Organic, EU Organic, and JAS Organic. Certification demonstrates that the honey is produced without the use of synthetic pesticides, antibiotics, or genetically modified organisms (GMOs).

Export Certificates: Karuna honey may need to obtain specific export certificates issued by the relevant authorities in Vietnam, such as a Certificate of Origin and Phytosanitary Certificate. These certificates verify the origin of the honey and declare compliance with phytosanitary regulations, ensuring that the honey is free from pests and diseases.

Singapore Food Agency (SFA) Registration: Karuna honey brand may need to register with the Singapore Food Agency (SFA) as an importer of honey. This registration ensures compliance with Singapore’s regulations and allows the brand to legally import and distribute their honey in the country.

|

|

OPPORTUNITIES

Increasing consumer interest in natural and organic products in Singapore

Growing demand for regional and unique honey varieties: Karuna honey can leverage the increasing demand for regional and unique honey varieties. By showcasing the distinct flavor profiles and floral sources specific to Vietnam, the brand can target consumers seeking authentic and diverse honey options. Highlighting the cultural and geographical significance of Vietnamese honey can further enhance its appeal.

Expansion into international markets

|

THREATS

Intense competition from established international brands and local brands

Regulatory challenges and quality standards

|

1.3 Sales channels

|

E-commerce platform

(B2C)

|

Official website of Karuna

|

|

Online marketplaces

( B2C)

|

Shopee: Shopee is consistently ranked as one of the most popular e-commerce platforms in Singapore. It offers a user-friendly interface, competitive pricing, a wide range of products, and various promotional activities that attract a large user base.

Lazada: Lazada is another highly popular e-commerce platform in Singapore. It has a strong presence in the market and offers a diverse selection of products, along with regular discounts and deals. Lazada also provides multiple payment options and reliable delivery services.

Qoo10: Qoo10 is also well-received by Singaporean shoppers and holds a significant share of the e-commerce market. It features a wide range of products, including electronics, fashion, beauty, and household goods. Qoo10 often offers attractive deals and discounts, attracting a loyal customer base.

Amazon.sg: Amazon has expanded its presence in Singapore with its local website, Amazon.sg. It offers a wide array of products and provides convenient shipping options for customers in Singapore.

|

|

Organic stores

(B2B)

|

The Green Collective: The Green Collective is a sustainability-focused store that promotes eco-friendly products. They prioritize organic and natural options and may be interested in featuring locally sourced honey.

SuperNature: SuperNature is a well-known organic store with multiple locations in Singapore. They offer a wide range of organic products, including fresh produce, groceries, personal care items, and household products.

Green Circle Eco-Farm: Green Circle Eco-Farm is an organic farm and store that offers organic produce, including vegetables, herbs, and eggs. They are known for their commitment to sustainable farming practices.

The Organic Grocer: The Organic Grocer is a renowned organic store located in Bukit Timah. They offer a comprehensive selection of organic groceries, fresh produce, dairy products, and baby food.

|

|

Health Food Stores

(B2B)

|

Nature’s Glory: Nature’s Glory is a well-known health food store that offers a wide range of organic and natural products. They specialize in organic food, supplements, personal care items, and household products.

Nature’s Farm: Nature’s Farm is a reputable health food store chain in Singapore. They provide a variety of health and wellness products, including vitamins, supplements, natural remedies, and beauty products.

Eu Yan Sang: Eu Yan Sang is a trusted brand with several outlets across Singapore. While they are known for their traditional Chinese medicine and herbal remedies, they also offer a selection of health foods, supplements, and wellness products.

Mahota: Mahota is a health and wellness concept store that combines a retail outlet with a restaurant and educational events. They offer organic and natural food products, supplements, herbs, and eco-friendly lifestyle items.

|

|

Specialty Farmers’ Markets

(B2C)

|

Farmers’ Markets by Kranji Countryside Association

PasarBella

⇒ These markets provide opportunities to showcase and sell your honey directly to consumers who appreciate organic and locally sourced products.

|

1.4 Potential customer’s persona

1, Health-Conscious Individuals in Singapore

|

Geographic

|

Reside in Singapore, who are in:

Health and Wellness Districts: Areas such as Holland Village, Bukit Timah, and Dempsey Hill are known for their health-conscious and wellness-focused communities. These regions often have a concentration of organic and health food stores, making them suitable for selling honey targeted at health-conscious consumers.

Residential Estates: Residential estates across Singapore can be potential markets for selling honey. Partnering with supermarkets, grocery stores, or local market stalls in residential neighborhoods allows for easy accessibility to residents who prefer shopping closer to their homes. ( Some big residential estates are Ang Mo Kio, Bedok, Bukit Batok, Jurong East,Pasir Ris, Tampines)

|

|

Demographic

|

Varied age groups ̣( both males and females)

(23-35 ): millennials who look for healthy products to stay healthy and prevent their future diseases

(40-60): people whose health start to go down and look for healthy options to improve their health

Typically middle to high-income earners,middle income: US$3,755/month (or US$45,066/year).

|

|

Market size

|

1 million

|

|

Psychographic

|

-

Prioritize personal health and well-being

-

Seek natural and organic products

-

Conscious about ingredient quality and nutritional benefits

|

|

Behavioral

|

-

Engage in regular exercise and fitness activities

-

Maintain a balanced diet

-

Actively seek out health-related products and services

-

Willing to spend on premium organic products

|

|

Pains

|

-

Concerns about the presence of artificial additives and chemicals in food products: Health-conscious individuals prioritize clean and natural food options. They are concerned about the potential negative health effects of artificial additives, preservatives, and chemical residues commonly found in non-organic food products.

-

Difficulty in finding trustworthy sources of organic and natural food options: They face challenges in identifying reliable sources that offer genuine organic and natural food products. They value transparency in labeling and seek brands that adhere to strict organic certification standards.

-

Limited availability of high-quality organic products in the market: Health-conscious individuals may struggle to find a wide range of organic options across various food categories, limiting their choices and variety.

-

Lack of information and transparency regarding the sourcing and production processes of food items: They desire detailed information about the origins, farming practices, and production methods of the food they consume. The lack of transparency can lead to skepticism and doubt about the authenticity of organic claims.

|

2, Family-Oriented Parents in Singapore

|

Geographic

|

Reside in Singapore, urban and suburban areas

|

|

Demographic

|

Typically females aged 25-45, with children of various ages.

There were 2,180,591 women in this age range in Singapore in 2021.

|

|

Psychographic

|

-

Parents who prioritize the well-being of their families

-

Concerned about the impact of processed and artificial ingredients on their children’s health

-

Value safety, authenticity, and natural products

-

Interested in cooking and baking healthy meals for their family

-

Enjoy engaging in family activities and spending quality time together

|

|

Behavioral

|

-

Actively seek out information and advice on parenting, nutrition, and natural remedies

-

Regularly purchase groceries and household essentials

-

Read labels and nutritional information

-

Look for organic options to ensure the highest quality and authenticity

-

Actively participate in online parenting communities and follow parenting blogs

-

Willing to invest in products that offer genuine benefits for their family’s well-being

|

|

Pains

|

-

Concerns about the health impact of artificial ingredients and preservatives on their children: Parents prioritize their children’s well-being and seek to provide them with wholesome and nutritious food options. They worry about the potential negative health effects of artificial ingredients, additives, and preservatives commonly found in processed foods.

-

Difficulty in finding organic and natural alternatives for children’s favorite food items: Parents face the challenge of finding organic substitutes for popular children’s food products, snacks, and treats. They aim to strike a balance between their children’s preferences and healthier organic choices.

-

Time constraints in preparing homemade meals using organic ingredients: Busy parents may find it challenging to consistently prepare homemade meals using organic ingredients due to time constraints. They may seek convenient and ready-to-use organic food options that align with their family’s dietary preferences.

-

Challenges in convincing children to adopt a healthier and organic diet: Parents may encounter resistance from children who are accustomed to processed or sugary foods. Encouraging children to embrace healthier and organic dietary choices can be a significant challenge for family-oriented parents.

|

3,Organic-Oriented and Eco-Friendly Consumers in Singapore

|

Geographic

|

Located in Singapore, urban and suburban areas.

|

|

Demographic

|

Varied age groups, diverse income levels, including young adults, families, and seniors.

|

|

Psychographic

|

-

Embrace sustainability and environmental preservation

-

Prioritize organic and eco-friendly choices

-

Seek products with minimal environmental impact.

|

|

Behavioral

|

-

Actively support organic farming practices

-

Engage in eco-friendly behaviors such as recycling and reducing waste

-

Prefer products with environmentally friendly packaging

-

Seek information about the origins and production processes of the products they purchase.

|

|

Pains

|

-

Frustration with the prevalence of non-environmentally friendly packaging in food products: They are conscious of the environmental impact of excessive packaging waste. They seek products that utilize eco-friendly packaging materials and practices.

-

Difficulty in distinguishing genuine organic products from those with misleading labels: Consumers may face challenges in identifying authentic organic products due to the presence of misleading labels or greenwashing practices by some brands. They strive to make informed choices and avoid products that falsely claim to be organic.

-

Challenges in finding a wide variety of organic options across different product categories: Organic-oriented individuals may desire a diverse range of organic choices beyond just fruits and vegetables, such as organic snacks, beverages, condiments, and other food items.

-

Frustration with the lack of awareness and education about the benefits and importance of organic and eco-friendly choices among other customers: Many consumers may still be unaware of the advantages of organic and eco-friendly products. Therefore organic-oriented and eco-Friendly consumers may require the company to provide more information and educational resources for other consumers to understand the positive impact of their choices on personal health and the environment.

|

4, Culinary Enthusiasts in Singapore

|

Geographic

|

Located in Singapore, urban areas with access to specialty food markets and stores.

|

|

Demographic

|

Varied age groups, including young adults, professionals, and food enthusiasts.

|

|

Psychographic

|

-

Passionate about cooking and exploring new flavors

-

Appreciate high-quality ingredients

-

Enjoy experimenting with recipes and unique food products.

|

|

Behavioral

|

-

Regularly purchase specialty ingredients

-

Follow food blogs and social media accounts for recipe inspiration

-

Actively seek premium and exotic food items

-

Willing to invest in gourmet and organic ingredients

-

Visit specialty stores and markets in search of unique culinary experiences.

|

|

Pains

|

-

Difficulty in sourcing high-quality and authentic organic ingredients for gourmet cooking: Culinary enthusiasts who value organic ingredients often face challenges in finding specialty organic ingredients required for their gourmet recipes. They seek premium quality organic ingredients to enhance the flavor and authenticity of their dishes.

-

Limited access to unique and exotic organic ingredients for culinary experimentation: These individuals desire a wide range of unique and exotic organic ingredients to experiment with new recipes and flavors. The limited availability of such ingredients may restrict their

|

EXPORT HONEY FROM VIETNAM TO SINGAPORE

1. Market shares

⇒ Most honey imported by Singapore originates from New Zealand as their market share amounts to 52%. The market share of Vietnam in the Singaporean honey market is 0.2%.

2. Tariffs

Since Singapore and Vietnam are both WTO members therefore if Karuna export honey to Singapore, its honey will be able to be applied the MFN tariff of 0%.

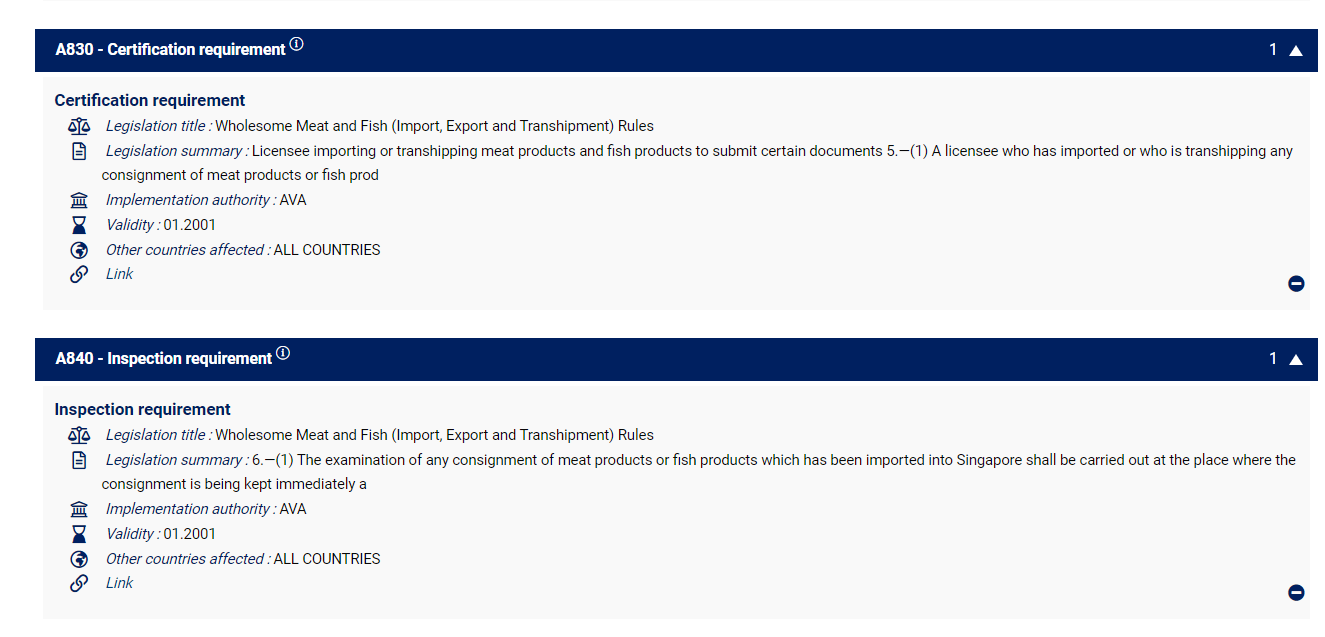

3. Requirements to export and import

-

Requirements of importing countries (Singapore) to the exporting country ( Vietnam)

To get the full document of each of these importing requirements

Step 1: Assess this website: Singapore Statutes Online

Step 2: Type the “ Legislation title” of each requirement on the search bar to get the full document

-

Requires of the exporting country ( Vietnam) to Vietnamese exporting company

To get the full document of each of these exporting requirements

Step 1: Assess this website: Thư viện pháp luật

Step 2: Type the “ Legislation title” of each requirement on the search bar to get the full document

Business model canvas for Singapore market